Netflix (NFLX) stock opened more than 8% higher on Friday after the streaming giant beat third quarter EPS and revenue estimates, and projected sales for the current quarter that came in ahead of Wall Street's expectations.

Revenue beat Bloomberg consensus estimates of $9.78 billion to hit $9.83 billion in Q3, Netflix reported after the market close on Thursday, an increase of 15% compared to the same period last year. The growth came as the streamer continued to lean on revenue initiatives like its crackdown on password sharing and ad-supported tier, in addition to last year's price hikes on certain subscription plans.

Netflix guided to fourth quarter revenue of $10.13 billion, a beat compared to consensus estimates of $10.01 billion.

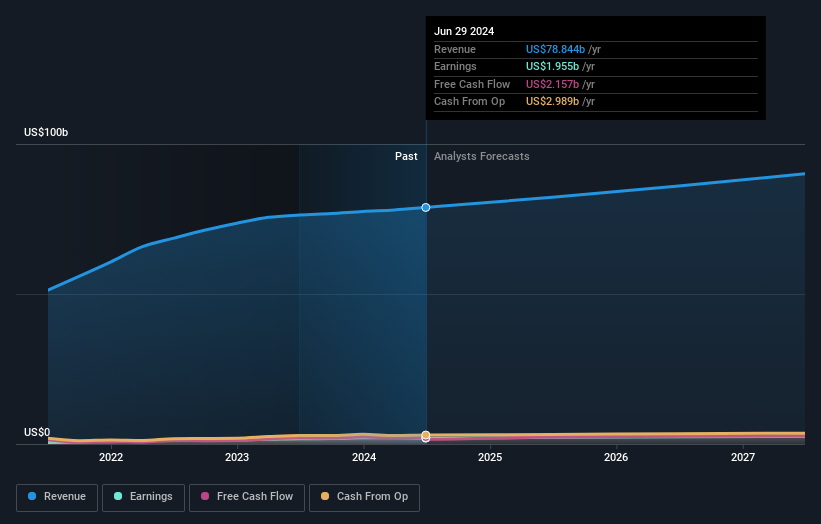

For full-year 2025, the company sees revenue hitting between $43 billion and $44 billion, compared to consensus estimates of $43.4 billion. This would represent growth of 11% to 13% from the company's expected 2024 revenue guidance of $38.9 billion.

It expects full-year operating margins to hit 27%, an increase from the previous 26%, after the metric hit nearly 30% in the third quarter.

Diluted earnings per share (EPS) also beat estimates in the quarter, with the company reporting EPS of $5.40, above consensus expectations of $5.16 and well ahead of the $3.73 EPS figure it reported in the year-ago period. Netflix guided to fourth quarter EPS of $4.23, ahead of consensus calls for $3.90.

Subscribers also came in strong with another 5 million-plus subscribers added on the heels of breakout programming like "The Perfect Couple" and "Nobody Wants This."

Subscriber additions of 5.07 million beat expectations of 4.5 million and follows the 8.05 million net additions the streamer added in the second quarter. The company had added 8.8 million paying users in Q3 2023.

"We expect paid net additions to be higher in Q4 than in Q3’24 due to normal seasonality and a strong content slate," the company said, citing upcoming releases like "Squid Game" Season 2, the Jake Paul vs. Mike Tyson fight, and two NFL games on Christmas Day.

Investors have praised the company's foray into sports and live events. Meanwhile, its ad tier continues to gain traction, accounting for over 50% of sign-ups in the countries where it's offered during the third quarter.

"We continue to build our advertising business and improve our offering for advertisers," the company said in the earnings release. "Ads membership was up 35% quarter on quarter, and our ad tech platform is on track to launch in Canada in Q4 and more broadly in 2025."